Teragonia’s solutions and experience have enabled rapid, material EBITDA gains for private equity portfolio companies and founder-owned businesses.

Our team has delivered on several engagements, with illustrative case studies below:

Developed local market KPIs and developed an operational process to optimize store acquisitions and growth plans

Consolidated 1000+ disparate instances of Quickbooks to develop P&L benchmarks for growth planning

Custom analytics solution to enable rapid growth including 8x store count and 30+ bolt-on integrations over four years.

Built lead funnels to enhance ROI leading to a 5% increase in conversions

Leveraged the diagnostic tool and identified pricing opportunities in days; currently implementing an operational plan to realize gains.

AI-powered customer feedback analysis to optimize content portfolio and lead generation; implementing AI solutions to realize 5x growth.

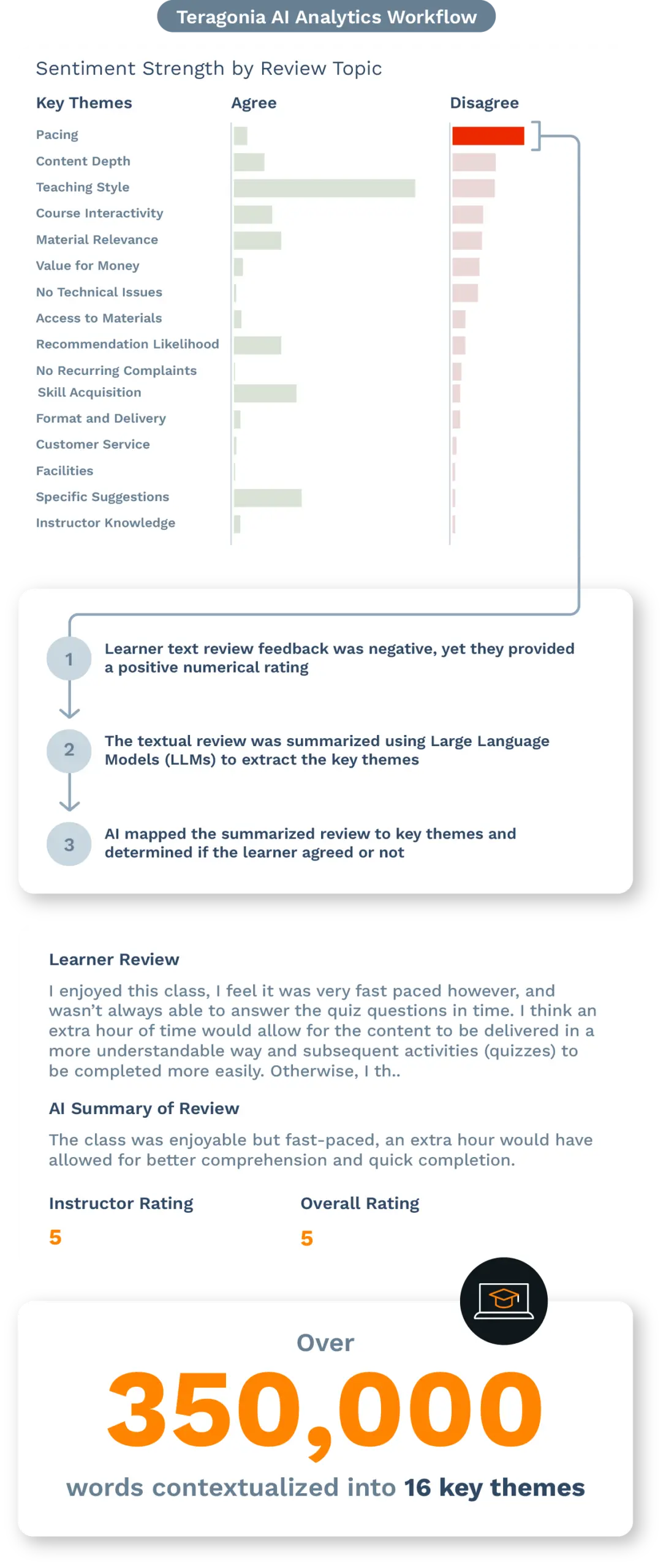

Traditional methods to analyze customer feedback provide limited insights to actionable outcomes. We enhanced traditional sentiment analysis with generative AI and analytics engineering to distill the key themes and provided actionable intelligence for C-suite decision-making. Reach out to learn more.

A PE-backed online education content subscription platform sought to overhaul its content portfolio based on historical learner feedback. However, the company encountered significant challenges in extracting actionable insights.

Key Data Feature Gaps

There was no mechanism to standardize key features such as learners’ industry, job title, and division. This was particularly challenging given there were more than 20,000 job titles in the database, diminishing the company’s ability to perform a deeper behavioral analysis.

Review and Rating Inconsistencies

Learner reviews often contradicted with the numerical ratings; for example, reviews identified hidden issues despite good/bad ratings.

Manual Analysis Challenges

Neither average ratings nor high-level sentiment analysis provided the detailed insights needed for the content optimization. A manual analysis of the extensive review catalog was impractical.

Actionable Intelligence Within Days

Teragonia analyzed course duration, content suitability, and trainer performance to empower management for establishing content optimization strategies, targeted marketing campaigns, and effective lead scoring.

Data Enrichment Leveraging Generative AI

Enhanced source data using generative AI for in-depth, multi-dimensional analysis.

Leveraged AI to automate the categorization of ~70,000 learners, by industry, division, and job level.

Summarized ~11,000 reviews with Generative AI using key sentiment labels (positive, neutral, negative) and identified recurring themes in feedback.

Visualized the analysis with dynamic drill-downs to various dimensions such as industry, division, job level, and course category.

Disclaimer: Our estimated enterprise value gains from analytics enablement are dependent on several project-specific variables. Terms of each engagement, including deliverables, will be governed by the respective master service agreement or engagement agreement. Please reach out to us to discuss.

Chartered Accountant | Institute of Chartered Accountants of Scotland

Master’s in International Accounting and Finance | University of Strathclyde, U.K.

Master’s in Finance | Mahatma Gandhi University, India

A proven business builder, innovator and M&A advisor with significant global experience, and adept in quantitative techniques and technology, Thomas brings forth a unique set of perspectives and capabilities to boost the systemic efficiency of fast-growing enterprises. Thomas has been a trusted advisor throughout his professional services career to several financial sponsors, sovereign wealth funds and Fortune 100 corporations, throughout the M&A life cycle from deal sourcing, deal execution, post-close value creation, to exit.

Prior to founding Teragonia, Thomas worked at Houlihan Lokey for five years where he established two successful and fast-growing practices from the ground up, including a traditional financial due diligence practice as well as a sophisticated data science practice. At Houlihan Lokey, he led the design and development of a fit-for-purpose, cutting-edge, and highly secure data science technology platform capable of hosting thousands of users and supporting several hundred clients. Leveraging the platform, he innovated several scalable and quickly deployable analytics applications creating significant value for the financial sponsor clients. Examples include various analytics and data science applications for deal sourcing, greenfield growth strategy, price optimization, salesforce effectiveness, customer retention, workforce rationalization, and location performance optimization.

Prior to Houlihan Lokey, Thomas spent more than a decade at Ernst & Young working in the Assurance, M&A Diligence and Strategy Consulting practices across the Atlantic.